If you’re of a certain age, you remember when a paycheck was just that — a physical object that you had to sign, take to the bank and wait in line to cash or deposit.

Eventually, direct deposit took over thanks to the proliferation of ACH, or Automated Clearing House, the complex system that allowed wages to be put in your account at a regular interval, provided you were someone with steady employment.

Compared to the old way of getting paid, it felt like a great leap forward. But in today’s on-demand, mobile world with its increased ability for instant transactions, ACH is pretty much only good for full-time employees with a set pay schedule.

Compensating for one-off or periodic gig work, expense reimbursements to an employee, rebates, or a gift for participating in a focus group — really, anything outside of standard payroll and repeating B2B transactions — is both a hassle and a slog for both the vendor and recipient, thanks to ACH’s increasingly obsolete structure.

To give you a better understanding of why ACH is an outdated system that doesn’t work well for many modern businesses, we’ve taken a look at its slow development, convoluted process, alternatives, and future.

Here’s everything you need to know about the Automated Clearing House, minus an answer to the question, “Why haven’t we moved on to something better already?”

Table of Contents

How ACH works

The concept of the clearing house dates back to the late 18th century, when London bankers would meet daily at a tavern to exchange checks and settle balances.

Things obviously improved over time, with B2B and payroll checks becoming a more streamlined system, though that still involved trips to the bank, waiting on checks in the mail, and other steps in transacting that now seem as quaint as the Pony Express.

It wasn’t until 1972 that the U.S. got its first ACH. Banks in California united with the Federal Reserve to start an electronic system in which banks, rather than process each transaction individually, settled up all their credits and debts in batches. Similar ACHs sprouted throughout the country and were only united nationally in the ‘90s.

While it’s understandable that the spread of ACH moved slowly in the pre-internet era, it’s downright bizarre how slow it is today with its three-to-five-day standard wait.

But it makes sense when you understand that the money you’re paying passes through multiple hands — your bank, an ACH operator (usually the Federal Reserve’s clearing house), the receiving bank — before finally landing in the payee’s account.

That doesn’t include the time it takes for you to gather the recipient’s banking info and authorization form to transact with their account, plus whatever other internal accounting you need to do.

Because the volume of these transactions is so massive, they’re processed in batches by the banks and clearing houses at certain times throughout the day. If you initiate the transaction too late in the afternoon, chances are it won’t be processed until the following morning, potentially adding another day to the lag.

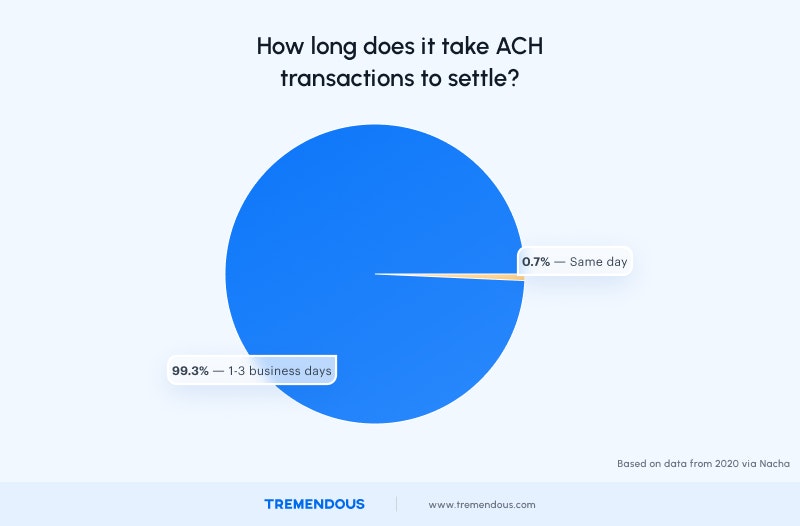

A payer can spring for a 5.2-cent fee for same-day ACH service, but most elect not to because the costs can be significant at volume. Just how rare is it? In 2020, only 0.7% of ACH transactions were settled in the same day.

The demand for faster payments

Just like paper checks, the use of cash is on the decline in the U.S. In a recent survey by Gallup, 60% of participants said they rarely or never pay with cash anymore, up from 32% in 2017.

In that five-year span, people who always or mostly used cash for their transactions dropped from 28% to 13%. A whopping 64% of respondents said it’s “very likely” or “likely” that physical currency will disappear altogether in their lifetimes in favor of electronic transactions.

Meanwhile, the demand for real-time payments is surging, particularly among younger people.

That’s, of course, due to the ubiquity of credit and debit cards, Google and Apple Pay, Zelle’s bank-to-bank digital system, the increased use of apps like Venmo and PayPal, and the growing popularity of cryptocurrency payments.

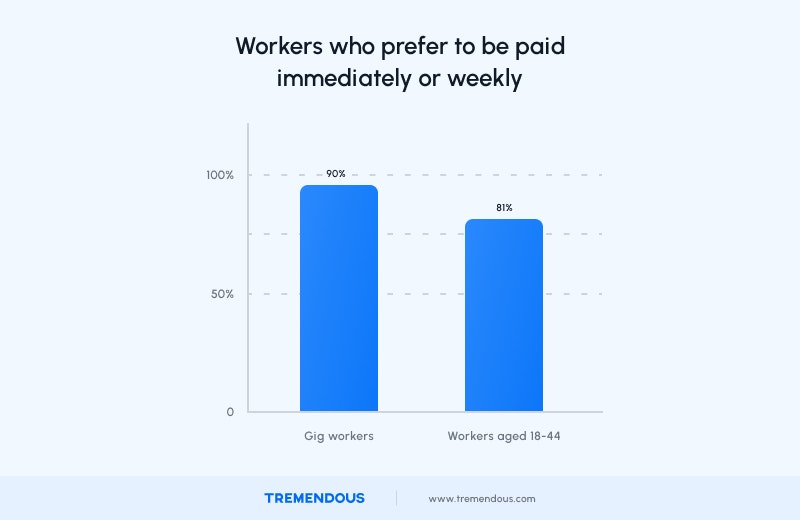

According to a 2021 study, 81% of workers aged 18-44 said they were more likely to take a job with an employer that offered on-demand wages, paid out at the end of a shift, project, or work week.

A whopping 90% of gig workers, who are often less likely to have any savings, want to be either paid immediately or weekly for their efforts.

It’s understandable that people would want money as soon as possible. The FDIC’s annual report on the financial well-being of Americans showed that, in 2021, only 68% of households could pay for a $400 surprise expense with cash or its equivalent.

11% could not afford the emergency expenditure at all — they had no ability to use a credit card, borrow, or sell off possessions quickly enough to raise that amount.

It’s no wonder that 12 million Americans take out payday loans annually, sometimes through apps like Dave and Earnin, other times from predatory, high-interest lenders.

It’s not just an issue for individuals, either. Many companies using ACH payments for sending and receiving invoices can’t afford the uncertainty of when, exactly, funds will settle up.

If you have many transactions in play, you could be out of sync with credits and debits, possibly ending up with an overdraft or forced to take more drastic measures.

To combat that precariousness, PYMNTS reports that businesses have resorted to reducing employees’ hours, hitting pause on new hires, and delaying inventory purchases, among other tactics that could be mitigated by speedier payments.

Uniquely American problems

The ACH network was built for U.S. banks. International financial institutions have moved ahead with their own systems, and the number of real-time transactions around the world reached 70.3 billion in 2020, up 41 percent from 50 billion in 2019.

The number of countries with real-time payments networks is now close to 60, boosting digital economies in developing and developed nations alike.

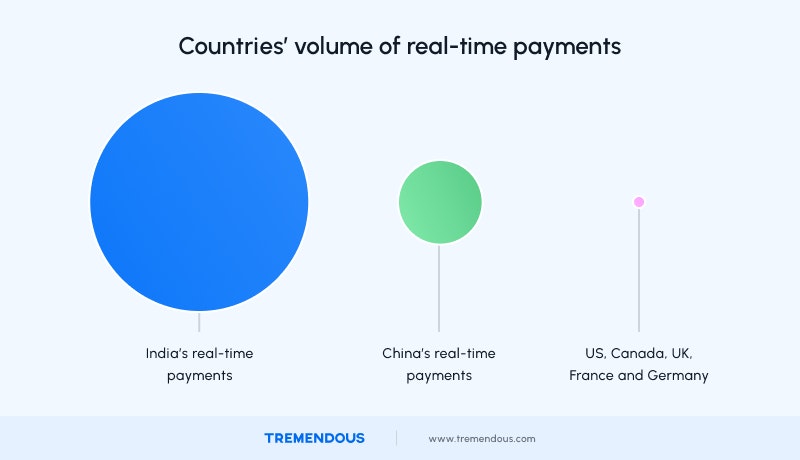

India accounted for the highest volume of real-time payments among businesses around the world, with over 40% in 2021, primarily through the country’s Unified Payments Interface (UPI) system and merchant QR codes.

India’s activity represents more than 2.6 times the volume of China, and is almost seven times greater than the combined volume of the U.S., Canada, the UK, France and Germany.

In Europe, SEPA (Single Euro Payments Area) is a great example of how ACH could work faster.

Rather than going through an entity like FedACH, it simply works bank to bank with the IBAN (International Bank Account Number) and/or BIC (Business Identifier Code) of the payer and recipient.

The longest time one of these transactions takes is two business days and most SEPA Credit Transfers, which are often used for one-off payments, are completed within a day.

There are also Instant Credit Transfers that take a mere 10 seconds or less — the primary reason it’s not the European standard is that not every bank has adopted SEPA Instant, and several countries don’t have access to it at all.

Using ACH to pay someone in another country can also be a headache. In addition to needing the recipient’s extra banking details like SWIFT number and specific codes, you have to deal with varying governmental regulations and longer wait times for processing.

Then there’s the fact that some countries aren’t even set up to accept ACH payments at all.

Setting all of this up for an employee’s regular paycheck might not be too cumbersome, but when it comes to one-off payments, the added steps and potential hold-ups can border on prohibitive for payers. (For what it’s worth, Tremendous recommends that international customers use a service like Wise, which still uses ACH for the “last mile” into our bank account.)

The quicker alternative for international payments is a wire transfer. Though they’re similar to SEPA in that they’re bank-to-bank transactions, these payments still take a day or two to settle, aren’t reversible even if there’s a mistake in the amount or recipient’s account number, and can cost upwards of $50 depending on where they’re headed — in fact, some banks even charge you to receive a wire.

This fee could be even more than the amount you’re giving to one of your customers or gig workers, and the costs for large batches of transactions could be a massive, if not crippling, blow to your finances.

Looking to the future

The U.S. knows its current ACH system is almost obsolete by modern standards. That’s why the Federal Reserve is planning a limited mid-2023 launch of FedNow, a service that will allow for instant payments 24/7 all year round.

It will take time to become ubiquitous, though, as banks large and small have to opt into the network.

Third-party institutions will still be involved and the timeline for consumer adoption is a question mark, as it depends on a number of variables including availability and awareness.

That’s all to say that if you’re not a fan of waiting a few days for ACH transactions to go through, surely you won’t have the patience for that system to become widespread in a year-plus.

And unfortunately, wire transfers, with their high costs and potential for irreversible errors, aren’t a great alternative, especially if you’re doing large batches of payments.

In an age where instant payments are more in-demand — and often needed — than ever, time is extremely valuable. And when one of the best things you can say about it is “at least it’s better than paper checks,” it’s clear that ACH’s time has passed.

It's way easier to send one-off payments instantly with Tremendous. Send payouts via direct deposit, Venmo, Paypal, or Visa prepaid cards to anyone, anywhere. All you need is an email address.