People ditched checks years ago. Why haven’t businesses?

By Russ Rizzo|5 min read|Updated Nov 17, 2022

People across the globe have all but abandoned physical checks in favor of digital payments because virtual options are faster to process, easier to manage, and less susceptible to fraud.

In the U.S., consumers use checks in less than 7% of all transactions—mostly for paying bills—and uniformly say they’re the worst type of payment option.

| Consumers’ preferred payment methods | |

|---|---|

| Debit | 34% |

| Credit | 31% |

| Cash | 28% |

| Other | 4% |

| Check | 2% |

[Source: 2021 Federal Reserve of San Francisco report]

The younger the consumer, the less likely they are to even have a checkbook.

| Consumers who prefer sending checks over digital payment options | |||||

|---|---|---|---|---|---|

| Under 25 | 25–34 | 35–44 | 45–54 | 55–64 | 65+ |

| 0% | 3% | 3% | 5% | 7% | 9% |

[Source: 2021 Federal Reserve of San Francisco report]

And yet, when it comes to paying their customers, businesses remain doggedly loyal to paper tender. Why?

By some estimates, one in three payments from businesses to consumers (B2C) are still physical—cash or check—each year. Considering businesses send an estimated $9 trillion to consumers annually, there’s an incredible amount of paper checks (and personal information) traveling around in mail trucks and FedEx planes at any given time. That's not to mention the very real risks associated with transporting and storing cash.

| Businesses remain loyal to paper tender | ||

|---|---|---|

| Digital | Cash or check | |

| Business-to-consumer (B2C) payments | 67% | 33% |

| Business-to-business (B2B) payments | 36% | 64% |

[Sources: 2021 Y Combinator article, “Brex: The Future of Business Finance and Cash Management;” 2019 Aite Group report]

For business-to-business (B2B) payments, companies lag even farther behind in making the switch, with checks and cash representing as much as two-thirds of the estimated $120 trillion in B2B payments made worldwide every year. According to some estimates, 81 percent of businesses still pay other firms with paper checks.

Table of contents

Consumers go digital

Meanwhile, consumers flocked to digital payments during the pandemic. Confined to their homes like never before, people were quick to adopt all things digital, from Zoom board meetings and virtual classrooms to e-commerce and Venmo.

From 2019 to 2020, consumers used a lot less cash as the pandemic spread and forced widespread lockdowns. People quickly migrated to a widening array of digital payment options and found they offered more benefits than simply being contactless.

Consumer surveys show digital payments are now preferred by more than three-fourths of consumers over cash and checks—and it’s not hard to see why.

Compared to traditional paper checks and cash, digital payments are:

faster (immediate vs. days in the mail),

cheaper (minimal fees vs. fees per transaction),

easier to track and manage (paper vs. digital trail), and

less susceptible to fraud (no personal information in the mail).

Businesses lag

Businesses, too, want to make and receive payments faster with fewer fees, headaches, and fraud risks. But they’ve been slow to change.

As BJ Gerjes, CEO of market research firm Creative Consumer Research, told us, “Doing paper checks is a living nightmare. It's been something that I wanted to get away from for a while.”

But, leaders say, switching entire ways of doing business is hard, no matter the benefits. It’s not an easy task sorting through all the payment options and their respective pros and cons, not to mention getting everyone at the company on board and comfortable with the switch. There’s new technology to learn and implement and new processes to define. It doesn’t happen overnight.

Businesses that are contemplating a change, however, find plenty of motivation beyond the fact that their customers want e-payments.

Costly business

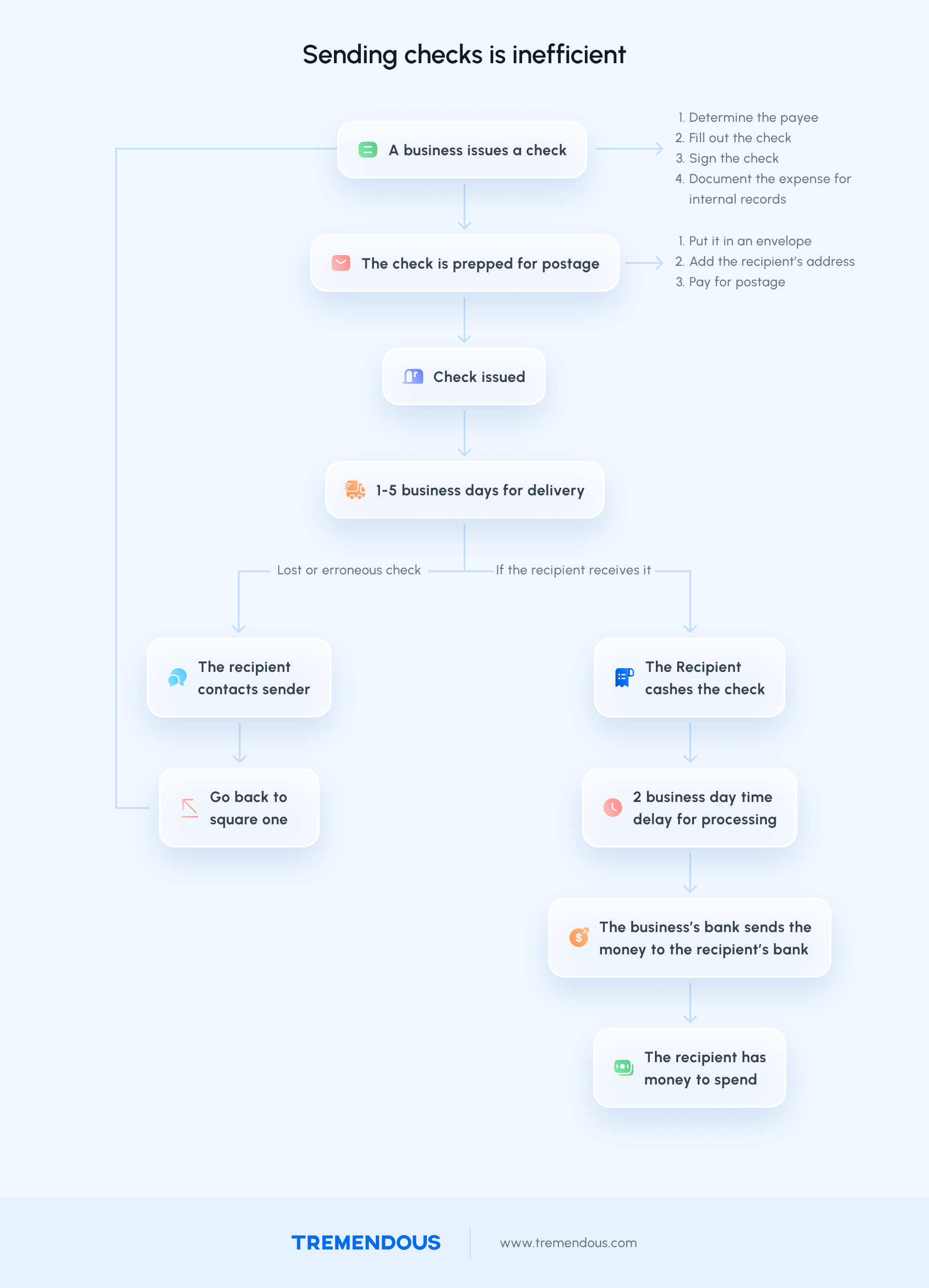

Considering that businesses spend between $4 and $20 to cut a single check, it ends up costing a lot of money to send money. To put those costs in perspect, a Tremendous client that makes 1,400 digital B2C payments in a year would pay an additional $5,600 to $28,000 in overhead to send those payouts by check. A larger company might send as many as 300,000 payouts in a year, which would result in $1.2 million to $6 million in expenses if paid by check.

The time businesses spend managing a check's paper trail accounts for a significant portion of the cost. It’s a manual, rather than automated, process, which means checks require significant labor to manage. Worse, all that work is fraught with the risk of human error and inefficiencies.

“At one point we sent out physical checks as rewards for expert interviews,” says a leader of a boutique research firm. “But we were a small company and to send out 20 or 30 checks meant an hour or two of work. At the end of the day, we were losing money doing it that way.”

If an accountant (earning the average U.S. salary of $57,620) sent those checks, that’s $27.70 an hour. If sent one day a week, that’s nearly $3,000 a year. If the accountant spent two hours each workday, that’s more than $14,000 a year in overhead.

Business leaders who made the switch to digital say they’ve greatly decreased the amount of time they spend managing payments while keeping better track of their accounts.

Fraud risk

They also sleep better at night, they say, knowing they’re at less risk of fraud. Because checks are easily lost (or stolen) in the mail, they’re susceptible to fraud. In fact, there are so many ways to defraud checks experts struggle to calculate the financial impact of check fraud. In a nutshell, your business’ account number and routing number are on every check, which could end up in the wrong hands. If a check doesn’t arrive, it must be resent, which means two copies are floating around—adding more fees and risk.

“Way back when we used to mail checks, I used to have fraud on the account all the time,” says one leader of a Texas-based research firm. “I had to close an account and open up a new one because of fraud.”

According to a 2020 survey of 520 companies across different industries, two-thirds of respondents who used checks reported being victims, or nearly becoming victims, of check fraud.

Diminishing benefits

For all their drawbacks, business leaders say, checks do carry some benefits over other payment types.

Perhaps the top reason for not switching is habit: Businesses who’ve used checks for decades are comfortable with the process and don’t want to change. Some find it easier to track payments using paper files (though their numbers are dwindling).

For others, checks offer the unique ability to “float” expenses and accumulate interest by taking advantage of the time it takes to arrive in the mail and then travel to the bank—or take advantage of “breakage” when consumers don’t cash their checks.

But, leaders say, those benefits diminish proportional to consumers’ rapid adoption of e-payments.

When it comes to which is better, checks vs. digital payouts, customers overwhelmingly have made up their mind.

Your employees probably don't like encountering checks in their daily life, so why should they be processing them for work?

Published March 31, 2022

Updated November 17, 2022