Introducing fraud prevention

By Kapil Kale●4 min. read●Oct 7, 2024

Payouts fraud has become rampant in every industry. Scammers fill out surveys with garbage data to get a survey reward, refer fake identities to get referral incentives, and cycle through email addresses to get paid as part of a class action settlement.

Losses are racking up. Fluent, a performance-based marketing company and a Tremendous client, reported fraud losses of over $250K in 2022. Last year, a client reported they lost $2.9M.

It’s not just dollars, either. It’s time-consuming to identify and chase down fraud. Plus, the fraudsters are getting smarter. They’re using AI as part of their grift. Trying to keep up with their methods is exhausting and demoralizing.

Today, we’re introducing a fraud prevention feature to help put an end to it. Our tool combines AI, custom rules, and a review process to stop fraudsters in their tracks. And it actually works– clients in our closed beta are raving about its effectiveness.

"The feature has flagged scammers for us based on country. It's saved us a ton of frustration. And we can trust scammers won't profit off our research budget anymore.”

Oliver Moadel, Q-Insights

It’s live in the Tremendous dashboard for all of our customers. And it’s totally free.

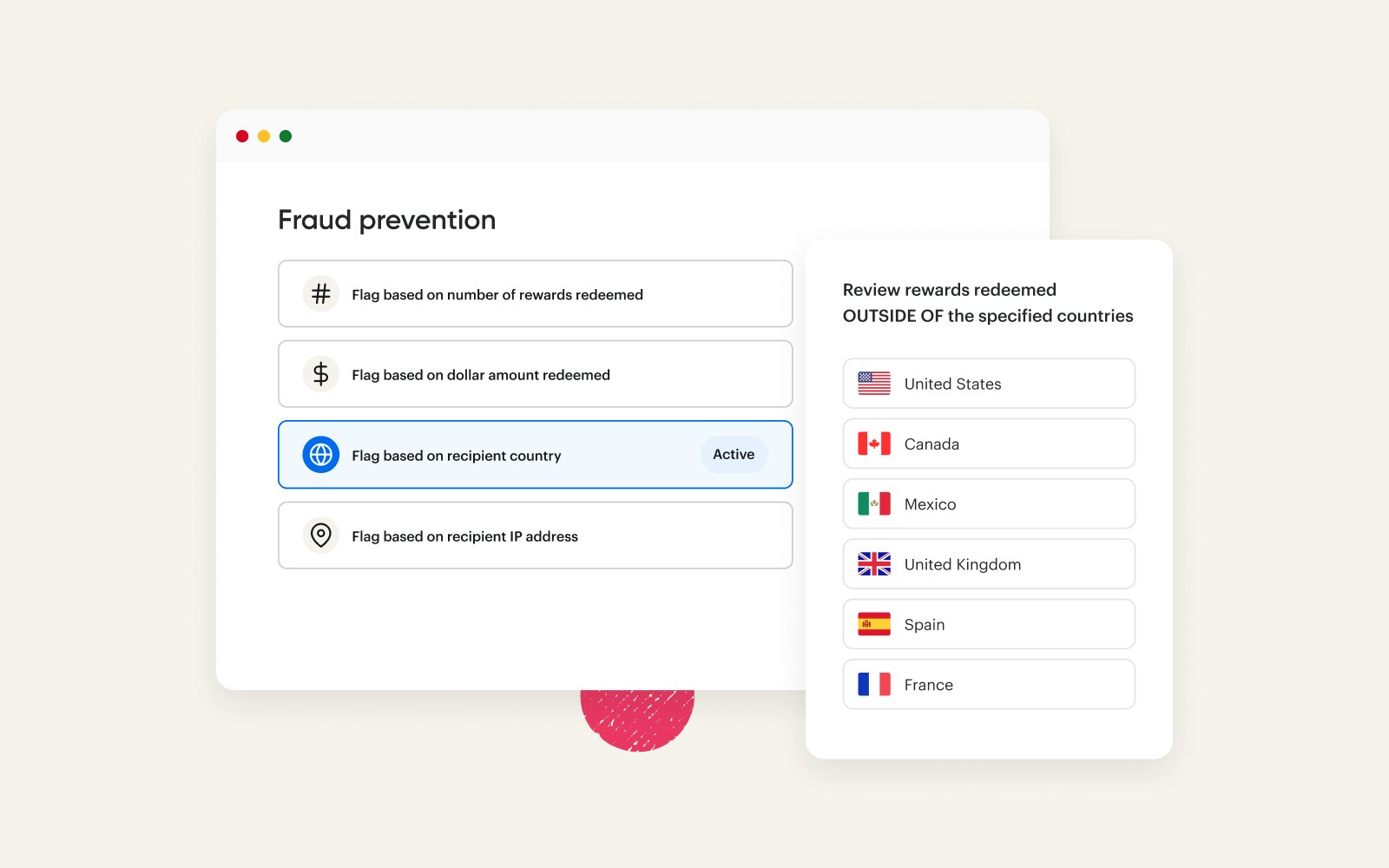

Customize controls to detect fraud accurately

Imagine you realize that hundreds of recipients are claiming rewards in Nigeria. If you’re doing user research in Nigeria, that’s going to look normal. But if you’re running a consumer promotion that’s only for US-based recipients, you’ll be very concerned.

Fraud looks different based on your business. That’s where our configurable rules come in.

You can:

Set custom thresholds for a maximum amount a recipient can claim in a day, week, month, or year

Set custom rules based on country

Set rules based on IP address or IP block

Identify recipients cycling through identities

Fraudsters pretend to be different people. They generate fake names, emails, and phone numbers, and then cover their tracks using VPNs.

Tremendous uses AI to detect this. We use browser, IP, device, and payment destination data to dedupe these multiple identities into the single person controlling them. When there’s a suspicious transaction, we’ll even show you the related rewards as proof.

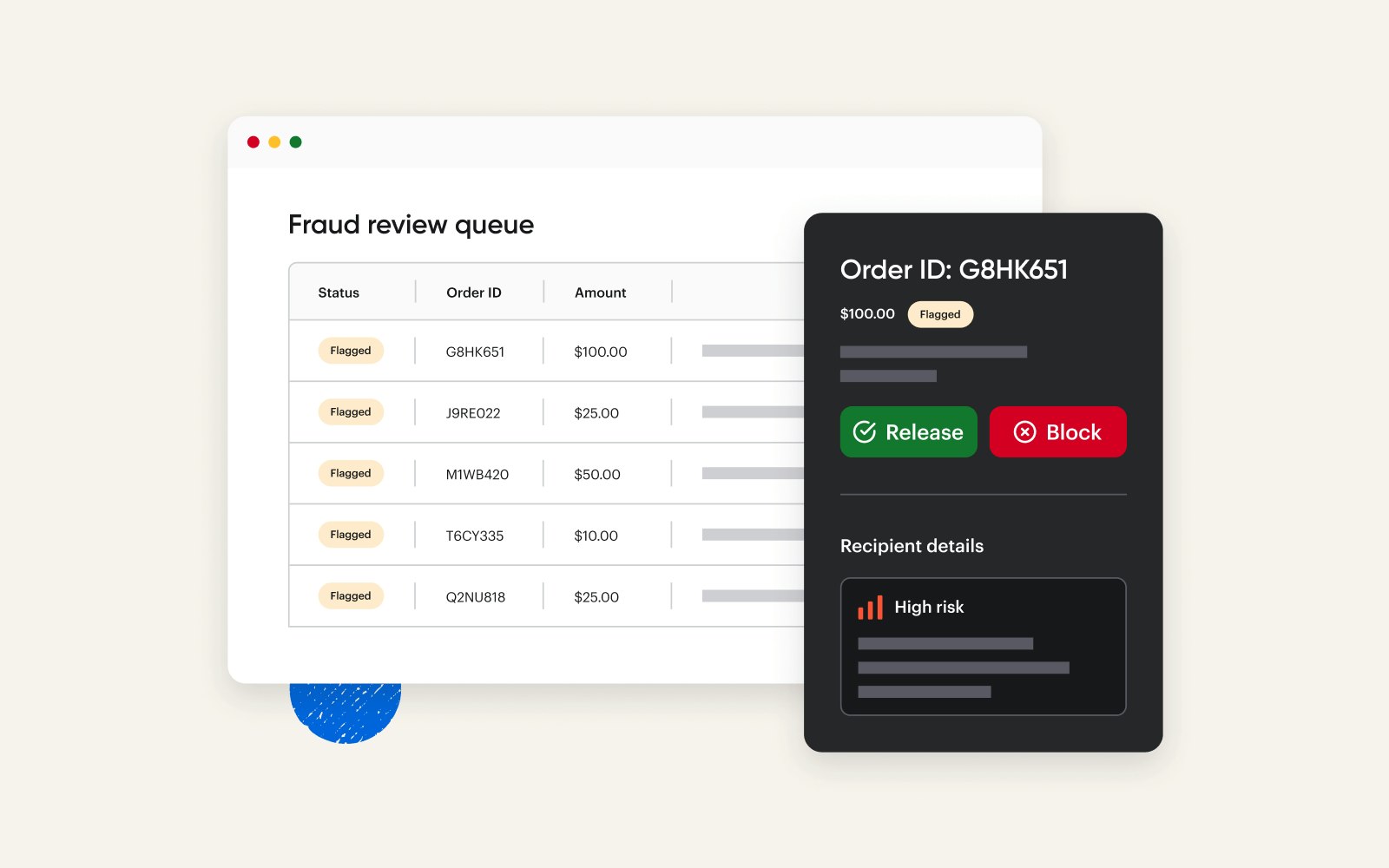

Protect the recipient experience

We want you to be 150% sure it’s fraud before you block a reward.

So when a reward trips a rule, it’s held in a review queue. That way, you can stop fraudsters while maintaining a smooth experience for those who actually earned their reward.

This review queue presents you with all the data you need to make a confident decision about whether to block or release a reward. You’ll get an explanation of why the recipient was flagged that includes details on their IP address, country, and redemption history.

“These users have invested time and effort. At the end of this journey, if we say ‘you’re disqualified, we aren’t paying you out,’ we better be confident in that.”

Jen Moore, Fluent

Fight fraud together

Fraudsters typically aren’t just individuals – they’re organized cybercrime enterprises targeting entire industries. It’s the same fraudsters causing expensive problems for all of us.

That’s why Tremendous’ fraud prevention feature is cooperative by design.

A special configuration allows you to identify and flag fraud detected across the Tremendous network of 10,000+ other organizations.

When you block rewards, our detection algorithms improve and help stop the same fraudsters who may be attacking other organizations.

The fraud problem is daunting, but we’re in this together.

The only fraud prevention feature in the industry

Tremendous is the only incentives and rewards platform that offers built-in fraud detection and prevention. For information on how to enable fraud prevention today, check out our feature guide.

Updated October 7, 2024