Employee recognition programs really do drive engagement

By Kate Monica●5 min. read●Oct 10, 2024

Giving your people incentives as part of an employee recognition program may seem like a small gesture. But according to dozens of studies, employees value these tokens of appreciation more than you’d think.

We’ve discovered that a $50 or $100 or $200 gift to employees could save you tens of thousands of dollars.

And a good employee recognition gift can drive real business value. The right incentive enhances employee motivation and performance. It can even spur greater levels of innovation.

Even more compelling: employees who feel supported by their organizations are more engaged at work and less likely to quit. In a labor market this tumultuous, that matters.

But there are two caveats.

To work, employee recognition efforts should be:

Distributed equitably

Based on individual contributions

Otherwise, they’ll feel hollow and thoughtless. And companies will end up spending extra money on employees for no real reason. They may even pay to make employees feel worse.

Most companies make some effort in the way of employee recognition, but everybody does things a little differently. Some offer words of affirmation, some provide bonuses, others give valued employees gift cards for their hard work.

We wondered whether employee recognition programs have any impact at all. So we combed through over 60 peer-reviewed studies and research articles on the topic to find out.

And we discovered they do, indeed, make a difference, according to a trove of resources published between 2010 and 2020.

But, importantly, certain employee recognition programs fare better than others. It all depends on the type of incentive, the industry, and the rationale for giving employees the incentive.

If you’re making a case for an employee recognition program at your company, we have plenty of evidence that it’s a worthwhile investment. And if you’re thinking of cutting your employee recognition program, it might be wise to think again.

TL;DR:

Financial incentives are most effective when they’re directly tied to performance.

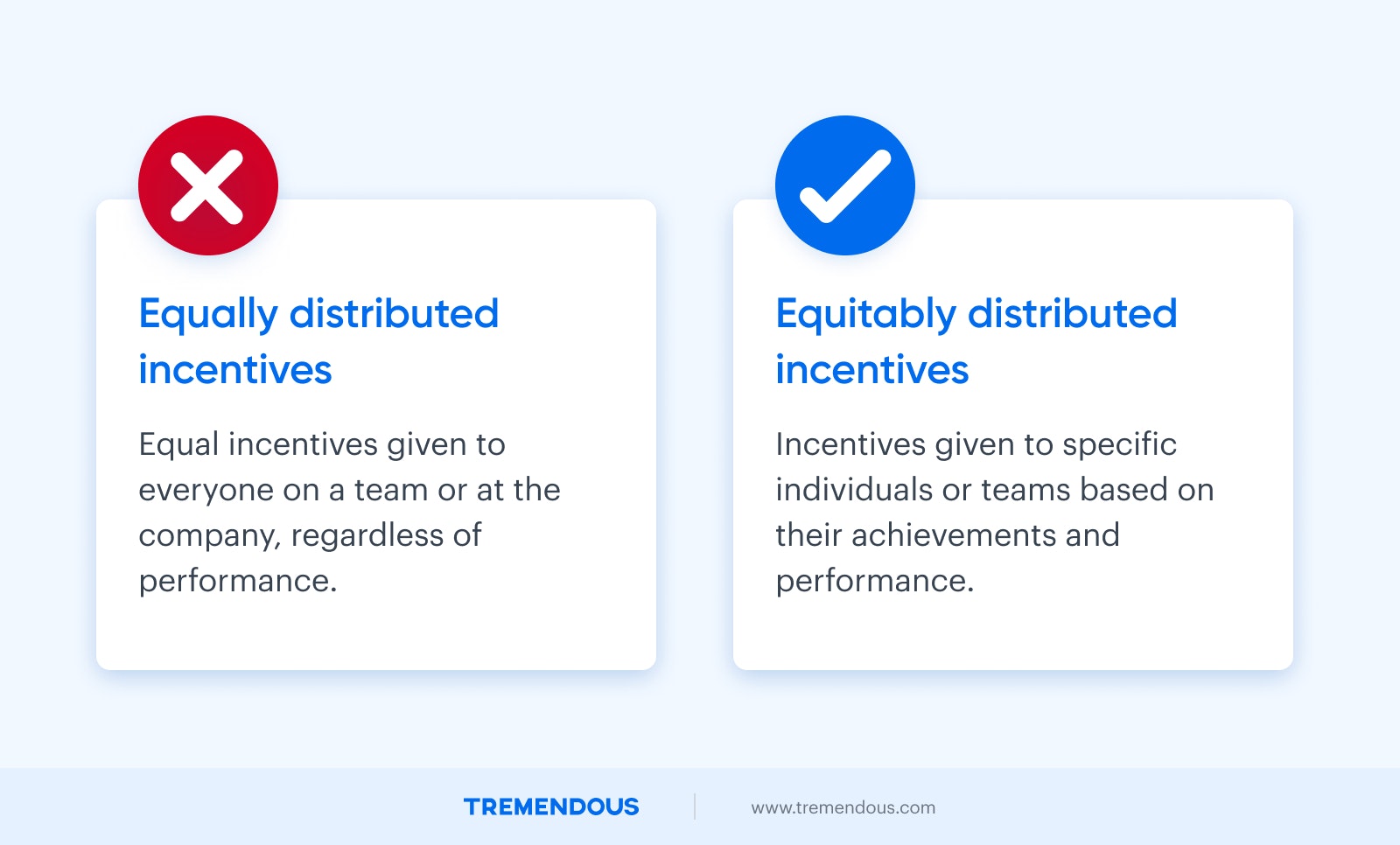

Incentives tied to performance are considered equitably-distributed incentives. Incentives given to everybody in the organization, regardless of performance, are equally-distributed incentives.

Equitably-distributed incentives lead to better employee performance. Equally distributed incentives do not.

Financial incentives are especially effective at increasing engagement of employees in the financial sector. But they don’t do much good in the caregiving and public sectors.

Highly-skilled and knowledgeable employees prefer bonuses and commissions.

Lower-skilled and less knowledgeable employees prefer profit-sharing and group-bonuses.

Don’t overcomplicate things. Adopting both individual and collective incentive schemes won’t drive up performance more than choosing one or the other. Weirdly, employing both kinds of schemes will decrease performance.

Table of contents

Financial rewards boost employee engagement in specific instances

Incentives tied to achievement lead to better employee performance

The business value of employee recognition incentives

Replacing valuable employees isn’t just a time expense for your recruitment team and hiring managers. It also comes with serious bottom line impact.

According to the Society for Human Resource Management (SHRM), companies pay between 90%-200% of the original employee’s salary in overall losses every time they lose and replace a worker.

So, let’s say you’ve got an employee that makes $50K a year. They quit. It’ll cost between $45-$100K in losses to hire somebody new. And that’s an avoidable expense.

Now multiply this number by each employee that leaves. The costs add up pretty quickly. You can see how the occasional incentive seems pretty cheap if it means people will stick around.

“It must be remembered that financial rewards are a vital and significant part of every job and, as such, have a tremendous role to play as Human Resource Management (HRM) tools,” wrote Shaw and Gupta in a 2015 article on the effectiveness of financial incentives.

Financial incentives can be an effective way of “fulfilling employees’ basic needs, attracting and retaining the best employees, increasing performance, or showing appreciation towards teams and individuals,” wrote authors in the report.

Another 2022 study found both individual (e.g., commissions) and collective financial incentives (like group bonuses and profit-sharing) can increase innovation at small companies.

But to be effective, these financial incentives should be directly tied to performance.

Salimi and della Torre analyzed microdata of more than 12,000 European small-mid-sized enterprises and found performance-related-pay (PRP) was associated with higher levels of innovation.

“Moreover, our results revealed that the effect of individual PRP on innovation is stronger in SMEs with high levels of human capital, whereas the effect of collective PRP is stronger in SMEs with low levels of human capital,” wrote authors in the study.

Here, human capital denotes the cumulative knowledge, skills, and experience of a business’s employees. Highly-skilled and knowledgeable employees tend to be positively influenced by commissions and individual bonuses.

Meanwhile, companies with lower-skilled employees tend to be more influenced by group bonuses and profit-sharing.

However, when businesses adopt both individual and collective incentive schemes, incentives can bizarrely start to have a negative impact on innovation. Building an over-complicated incentive scheme hurts more than it helps.

“Interestingly, when both individual and collective PRP schemes are adopted, their association with firm innovation is significant but negative, indicating that the adoption of multiple pay incentives may be detrimental to SMEs’ innovation,” wrote authors in the report.

It’s best to keep your incentive structure simple and straightforward.

Financial rewards boost employee engagement in specific instances

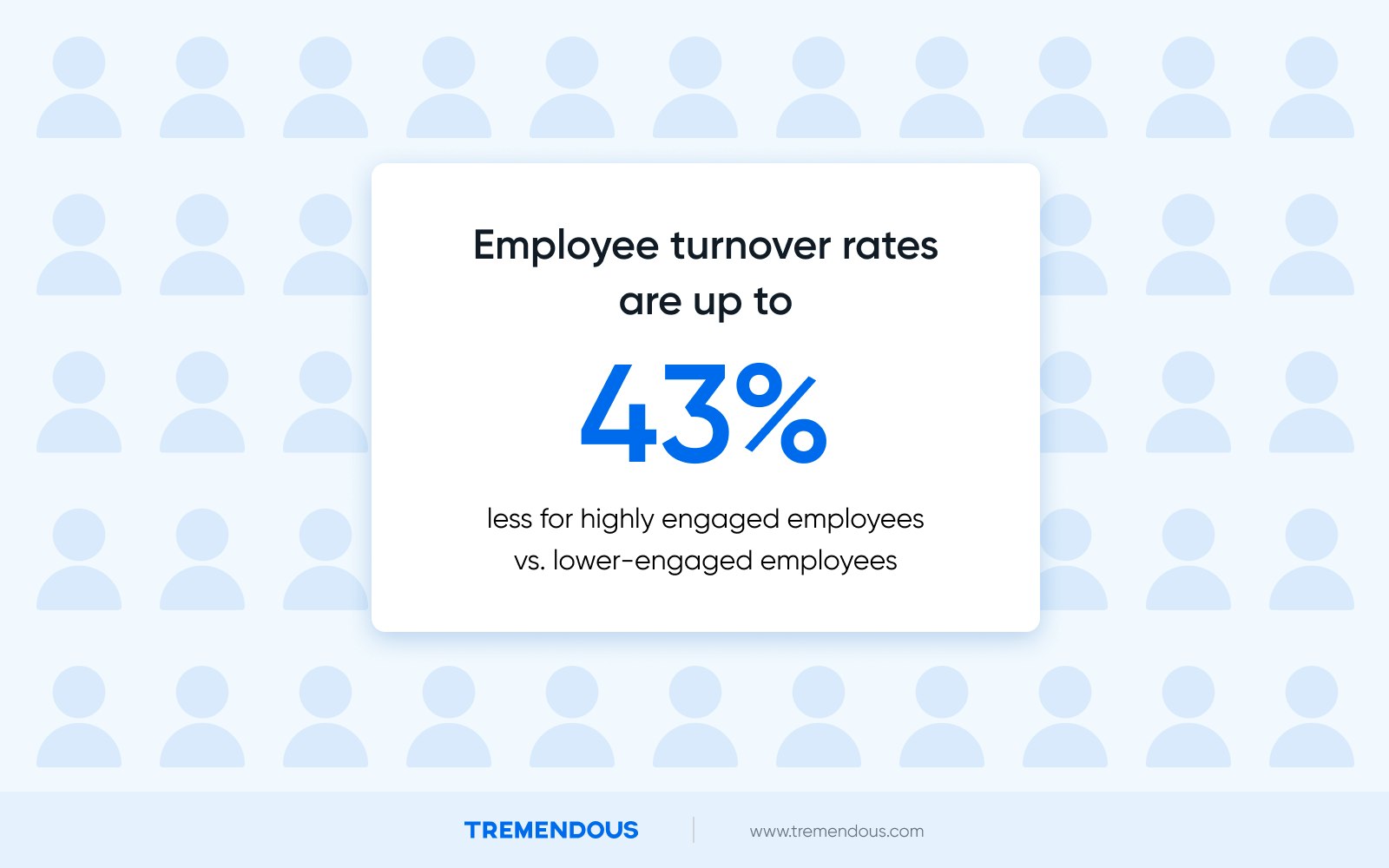

Employee engagement has a direct effect on employee turnover rates. Basically, if employees are emotionally committed to their work and their company, they’re a lot less likely to quit.

According to a 2020 study, employee turnover rates were up to 43% lower for highly-engaged employees compared to lower-engaged employees.

So, fostering a high rate of employee engagement is important. But are financial incentives a good way to do it?

According to our research, it depends on the industry.

One 2020 study by Lee et. al. found a weak relationship between financial rewards and employee engagement in the caregiving and public sectors.

However, they observed that financial rewards significantly increased engagement in the financial sector across the U.S., Mexico, and the Netherlands.

Additionally, researchers found equitably distributed rewards are a main driver for employee engagement (Saks, A.M. 2019).

In addition to providing social support and opportunities for learning and development, financial incentives and employee recognition efforts can meaningfully boost employee engagement.

Incentives like commissions, SPIFFs, holiday gifts, and other financial incentives increase engagement.

Money is especially persuasive in the financial sector. Turns out, people who work with money are motivated by money.

But not bonuses, benefits or pay.

One study found “no direct evidence” between these financial rewards and work engagement levels (Kulikowski, K., & Sedlak, P. 2020).

“There is insufficient evidence to claim that pay, benefits, and bonuses are related to employee work engagement levels.”

Incentives tied to achievement lead to better employee performance

All forms of financial incentives may not be firmly correlated with increased employee engagement.

But we found they’re definitely correlated with higher employee performance.

A meta-analysis of 146 studies concluded that team-based financial incentives have a significant impact on employee performance.

“Our study demonstrates the importance of rewarding employees as teams to motivate them to a greater extent,” wrote authors in the report.

“The results show that equitably distributed rewards lead to higher performance [compared to] equally distributed rewards.”

Delineating between “equitably” and “equally” distributed rewards may seem like a nit-pick.

However, there’s a big difference: equally distributed rewards are the same for every team, regardless of performance.

Equitably distributed rewards are fair based on the performance of each person or team.

We also found in our review of the literature that team-based incentives motivate highly productive workers to help coworkers in small teams.

So team-based financial incentives don’t just improve individual performance. They improve the performance of the team as a whole by driving greater collaboration.

Conclusion

Over 60 research studies demonstrate the impact financial incentives can have on employee retention, innovation, engagement, and performance on both the individual and team-level.

Financial incentives for employee recognition come in many forms: competitive pay, commissions, bonuses, and holiday gifts.

Consider allocating budget to employee recognition programs as part of other employee retention initiatives.

Want more details? We did original research on how much it costs to make employees feel valued in the context of holiday gifting, and found that a little goes a long way.

Updated October 10, 2024